Help for Londoners struggling with money worries and debt

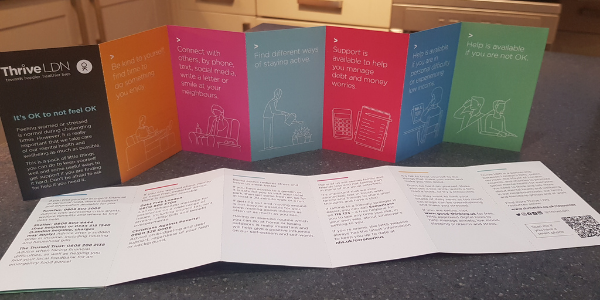

Thrive LDN and partners have distributed more than 120,000 wellbeing cards to foodbanks, debt advice charities, Transport for London, and other organisations, to support some of the most vulnerable Londoners during the coronavirus pandemic.

Pocket sized and packed with information, they offer tips on wellbeing, how to deal with stress and anxiety and where to get more help if you need it.

The wellbeing card packs include information on how to get support and advice for debt and low-income by phone or text, alongside information to support mental health and wellbeing. They follow a similar initiative which supported the wellbeing of Londoners clinically shielding during the first lockdown.

The pandemic has caused economic hardship for many in the capital, and there are clear links between debt and money worries and developing poor mental health. Worry about money can affect sleep, concentration, productivity and stress levels. It is also a known factor in suicide. Furthermore, we know that people on lowest incomes are more likely to have limited or no digital access, so these physical resources will also support people who don’t have access to online information.

Finding support with money worries and debt

If you are worried about money or need impartial advice, there is support and information available for you. Don’t be embarrassed or afraid to ask for help if you need it.

- Throughout January and February, Debt Free London’s helpline has been open 24 hours a day with support from Thrive LDN and the Mayor of London. Call 0800 808 5700 or visit their website for other ways to get in touch.

- If you’re looking for practical advice and strategies to manage wellbeing, then watch a free NHS-led wellbeing webinar on Managing Financial Anxiety, developed in partnership with Money A&E and Mental Health and Money Advice.

- If you’re feeling anxious or stressed about work, housing or personal difficulties, then explore the helpful range of resources and guidance on City Hall’s Hub.

- There are a number of other resources and services available to support your mental health and wellbeing during this challenging time. Explore these here.

The impact of financial hardship on wellbeing

Those who are in debt or in personal difficulty are more likely to be at risk or poor mental health. The wellbeing cards provide simple and clear messages to help people find support and keep themselves well, despite any sudden and complex situation they may find themselves in. In the context of the impact of pandemic this is important.

Research by the national poverty charity Turn2Us found that one in three people (34%) have got into debt since the start of the pandemic. More than one in ten people (12%) have resorted to missing a bill or debt repayment, up from 3% before the coronavirus crisis. Turn2Us found that a fifth of the population – 11 million people – are running out of money ‘always’ or ‘most of the time’ before the end of the week or month, an additional 4.2 million people since March 2020.

According to research by the charities Step Change and Gingerbread, over eight in ten single parents said not having enough income to meet living costs was forcing them into debt.

We know that the economic impact of Covid has disproportionately affected those who are already socially disadvantaged or marginalised. Research by the Institute for Employment Studies show that low-paid workers are more likely to have seen a fall in their income and to be worried about their finances – and they are also far more likely to be women, young people, migrants, and people from black, Asian and ethnic minority communities.

The situation is particularly difficult for people claiming benefits. A study by five universities for the Welfare at a Social Distance project looked at the experiences of thousands of people who signed on after losing their job during the crisis. It found that even with the temporary extra £20 many struggled to get by, and were forced to borrow, run up credit card debt, or use food banks.